Table of Contents

- Different Types of FSAs

- What Expenses are Eligible?

- Can I use my FSA to Purchase Medical Supplies like Incontinence Products?

- How to Purchase Incontinence Products Using an FSA

- Tranquility® Products and FSA

- What is an HSA and Does it Cover Incontinence Supplies?

A Flexible Spending Account, or FSA, is a dedicated account through many employers where you can set aside money to pay for certain healthcare costs. The most important feature of FSA accounts is that the money is not taxed, meaning you do not pay state or federal taxes on the money you place in an FSA. You can use your FSA to pay for things like copayments, deductibles, certain drugs and some other healthcare costs. Some medical supplies, such as incontinence care products, may also be eligible.

Different Types of FSAs

FSAs are only available to employees of eligible companies that offer these accounts. For people who are self-employed, a Medical Saving Account (MSA) may be used to set aside money for medical costs. The IRS sets the rules for funding and accessing FSA funds and defines what healthcare expenditures are eligible and approved.

The IRS sets rules for the amount of money you can deposit into a Medical FSA and these limits are subject to change each year.

During the 2025 plan year, you can contribute up to $3,300 through payroll deductions. Typically, those funds must be fully used within the plan year; however, some employers offer a grace period or carry-over, where employees are given extra time (typically up to two-and-a-half months) to spend their FSA money. Per the IRS, $660 is the maximum amount that can be carried over from 2025 to 2026.

This means that you must plan carefully with how much you deposit into your FSA, because you may end up forfeiting any money that isn’t spent.

Since FSAs are provided through employers, it’s best to contact a Human Resources employee with all questions related to starting and using an FSA.

What Expenses are Eligible?

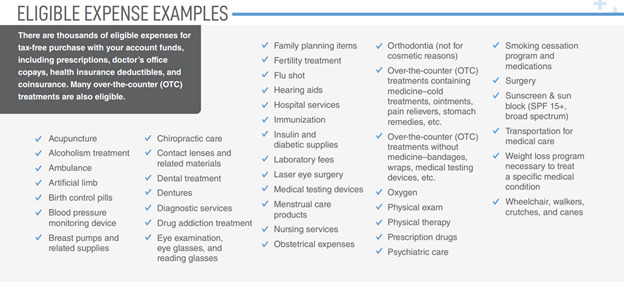

There are thousands of FSA-eligible expenses! The most common expenses are copays, prescriptions and insurance deductibles. Other noteworthy eligible expenses include medical equipment like wheelchairs, walkers and canes, as well as hearing aids, physical therapy, transportation for medical care, oxygen and more. FSA funds can also be used toward large expenses like surgery or a medical procedure.

Here is a large list of eligible FSA expenses.

Can I use my FSA to Purchase Medical Supplies like Incontinence Products?

The CARES act (Coronavirus Aid, Relief and Economic Security) that was signed into effect in 2020 expanded FSA eligibility for many over-the-counter items. You no longer need a prescription to purchase FSA-eligible items like blood glucose monitors and testing strips, blood pressure monitors, athletic and orthopedic braces and supports, contact lenses and supplies, and many more.

Home medical equipment like CPAP supplies, wheelchairs and walkers, and even incontinence products are typically eligible to be purchased using a Medical FSA. It’s important to note that this refers to incontinence supplies for adults and that diapers for babies or children may require a Letter of Medical Necessity or doctor’s prescription. That said, children ages 3 and older with complex healthcare needs are typically eligible for Medicaid benefits, regardless of their parents’ income. If this applies to you, you have a disability or are a low-income older adult, please read our article called Does Medicaid Cover Incontinence Supplies or Adult Diapers?

Incontinence products can be expensive, costing individuals or families thousands of dollars per year. Using an FSA to pay for incontinence supplies can save you hundreds of dollars each year. Read on to learn how to purchase incontinence supplies using an FSA.

How to Purchase Incontinence Products Using an FSA

Depending on your employer and FSA program, there are a few ways to use your account to pay for incontinence supplies.

- FSA Debit Card – Some FSA programs provide contributors with a debit card to use for FSA purchases. At checkout in-store or online, you can use your FSA debit card just like any other debit card, but for FSA-eligible purchases. Using an FSA debit card eliminates the need for you to pay out-of-pocket for the eligible expense and wait for reimbursement. However, you will likely still need to submit paperwork and the receipt from your purchase, so be sure to always keep your receipt when using an FSA.

Note: Not all retailers (in-store and online) accept FSA debit cards, and your payment can be declined due to ineligible items or insufficient funds. It’s recommended to have an alternative form of payment available in case your FSA debit card is declined. - Out-of-Pocket Payment with Reimbursement Form – If your FSA provider does not offer an FSA debit card, you will likely need to make the purchase using another payment method (cash or credit card) and submit paperwork for reimbursement. Reimbursement forms are usually available when you log in to your FSA account, and instructions should be on the form. After the request is processed, you will receive a check or payment through direct deposit. Again, be sure to keep your receipt from the purchase, as this will be necessary proof of the medical products purchased.

If you are new to using an FSA, be sure to contact your employer or FSA provider to request the specifics for your plan. They can help you better understand what medical products and services are covered, the best way to pay for them, and any documentation or information you need to ensure coverage.

Tranquility® Products and FSA

Tranquility works with Durable and Home Medical Equipment (DME/HME) companies and pharmacies across the county to offer the best and most absorbent incontinence products. Many retailers that sell Tranquility accept FSA accounts to purchase Tranquility Products.

As a manufacturer of absorbent solutions for over 30 years, we pride ourselves on making the most absorbent, highest-quality, durable and comfortable incontinence products. Shop our wide selection of absorbent products to help determine the right product to try. You can also take our short survey to receive a free two-pack sample of any Tranquility product. Contact us if you need any support or advice on product selection.

What is an HSA and Does it Cover Incontinence Supplies?

A Health Savings Account, or HSA, is another type of dedicated account where you can set aside money to pay for certain healthcare costs. Similar to an FSA, you can elect to have pre-tax dollars set aside into this HSA account. However, to be eligible for an HSA, you must enroll in a High Deductible Health Plan, meaning a plan with a higher deductible and a (typically) lower monthly insurance premium. Not all employers offer a High Deductible Health Plan, making HSAs less common than FSAs.

One of the main benefits of HSA accounts is that is can be used as a supplemental retirement account because the money rolls over each year. Unlike FSA accounts where the money typically has to be used each year, HSAs allow for funds to be rolled over and invested.

When it comes to coverage of incontinence products, HSA dollars can be used to purchase absorbent products and other medical supplies. The method to purchase is similar to what is described above for FSA accounts. Some HSAs provide you with a debit card and others require out-of-pocket payment with a reimbursement form.

FSA and HSA accounts are a great way to save hundreds of dollars per year when purchasing incontinence supplies. If you regularly purchase incontinence products to manage your bladder or bowel leaks, these accounts are a safe and cost-effective way to save money on planned medical expenses. Contact your employer or FSA/HSA provider with account or eligibility questions.

Robert Recker

Robert is a Senior Manager of Content Marketing for Principle Business Enterprises, parent company of Tranquility Brand Continence Care Products. He has 15 years of experience creating online educational content in the healthcare industry, specializing in medical supplies.

For more information or questions about this article, please call 1-419-352-1551 or email CustomerService@pbenet.com.